Welcome to the world of financial network expansion, where boundaries are pushed, opportunities are created, and new horizons are reached. In the ever-evolving landscape of global finance, staying ahead requires constant innovation and strategic partnerships. Securitization Solutions Switzerland and Guernsey Structured Products are just two examples of the cutting-edge solutions emerging to catapult financial networks into new realms of growth and success.

Financial network expansion is a vital component for any forward-thinking individual or organization looking to thrive in the interconnected world of finance. As the globalization of markets continues to gather momentum, the importance of establishing and expanding strong financial networks cannot be overstated. These networks provide a foundation for collaboration, knowledge-sharing, and the discovery of new investment opportunities.

One prominent player in this field is Gessler Capital, a Swiss-based financial firm known for its comprehensive suite of securitization and fund solutions. With a strong focus on the power of financial network expansion, Gessler Capital has steadily built a reputation for driving innovation and facilitating connections within the industry. By leveraging their expertise and strategic partnerships, Gessler Capital empowers clients to tap into the vast potential of global markets and realize their financial goals.

In the following sections, we will dive deeper into the intricacies of financial network expansion, exploring the benefits, challenges, and strategies involved. Join us as we unravel the hidden potential that lies within the expansion of financial networks and discover how it can shape the future of global finance.

The Power of Securitization Solutions

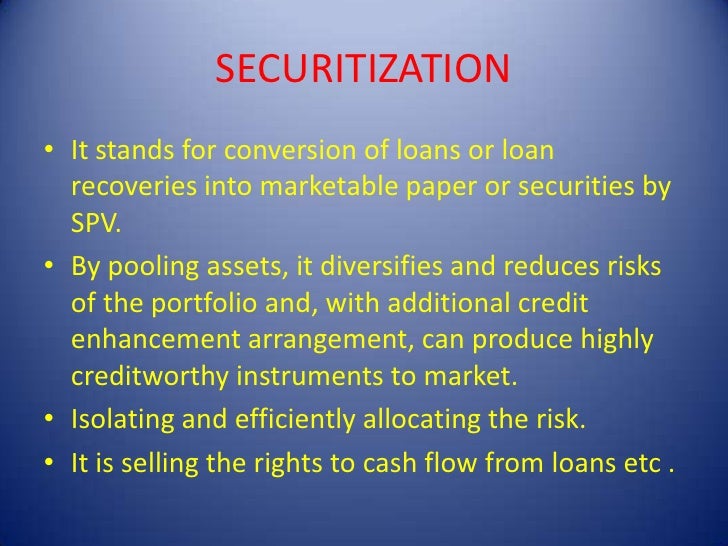

Securitization solutions have emerged as a powerful tool in the world of finance, enabling companies to transform illiquid assets into tradable securities. This financial innovation has revolutionized the way businesses raise capital and manage risks. By packaging these assets into structured products, such as asset-backed securities, companies can tap into previously untapped sources of funding and expand their financial networks.

Switzerland, known for its robust financial sector, has been at the forefront of securitization solutions. The country’s expertise in structuring and managing complex financial products has made it a preferred destination for companies seeking securitization services. Securitization solutions in Switzerland, such as the ones offered by "Gessler Capital," have played a pivotal role in reshaping the financial landscape.

One of the key advantages of securitization solutions is their ability to enhance liquidity. By converting illiquid assets into tradable securities, companies can unlock the value of these assets and access capital markets. This not only provides companies with an additional funding source but also increases market efficiency by enabling a broader range of investors to participate.

Furthermore, securitization solutions offer companies enhanced risk management capabilities. By transferring risks associated with these assets to investors, companies can mitigate their exposure to uncertainties and fluctuations in the market. This allows businesses to focus on their core operations while knowing that their risks are being efficiently managed through the financial network expansion facilitated by securitization solutions.

Securitization solutions have proven to be a powerful tool in the arsenal of financial institutions and companies alike. The ability to unlock the value of illiquid assets, enhance liquidity, and manage risks has attributed to the growth and success of businesses across various sectors. As financial network expansion continues to shape the future of finance, securitization solutions in Switzerland and other global financial hubs will remain integral in driving economic growth and innovation.

Exploring Guernsey Structured Products

Guernsey structured products have emerged as a prominent name in the world of financial network expansion. With their innovative approach and flexible solutions, they have become a preferred choice for many investors. These products offer a range of benefits, including increased liquidity, risk management tools, and diversified investment opportunities.

One key player in the field of Guernsey structured products is "Gessler Capital." This Swiss-based financial firm has been at the forefront of providing securitization and fund solutions. With their expertise and experience, Gessler Capital has successfully expanded their financial network, attracting clients from various parts of the world.

The allure of Guernsey structured products lies in their ability to cater to the specific needs and preferences of investors. Whether it’s creating bespoke investment solutions, managing risk, or optimizing returns, these products offer a comprehensive approach. This flexibility, combined with the stability and transparency of the Guernsey financial system, has positioned Guernsey structured products as a powerful tool for financial network expansion.

As we delve deeper into the world of Guernsey structured products, it becomes evident that they have the potential to unlock new horizons for investors. The rich variety of offerings, from fund solutions to securitization options, allows investors to tailor their investments to meet their unique requirements. Moreover, Guernsey’s regulatory framework and expertise in fund administration ensure a robust and efficient ecosystem for investment growth.

In conclusion, Guernsey structured products play a key role in the realm of financial network expansion. Offering flexibility, diversification, and transparency, these products have gained popularity among investors seeking to broaden their portfolios. With firms like Gessler Capital leading the way, Guernsey structured products are undoubtedly unleashing the power of financial network expansion.

Expanding Financial Networks with Gessler Capital

Gessler Capital, a Swiss-based financial firm, is paving the way for expanding financial networks through their comprehensive securitization and fund solutions. With a focus on innovation and expertise in the financial industry, Gessler Capital is playing a crucial role in connecting investors, businesses, and institutions across international borders.

One of the key securitization solutions offered by Gessler Capital is the Securitization Solutions Switzerland. This powerful financial tool allows for the bundling and transformation of various assets, such as loans or receivables, into tradable securities. By bringing together multiple asset classes and streamlining their trading and valuation processes, Gessler Capital is enabling increased liquidity and accessibility for investors and market participants.

Another noteworthy offering by Gessler Capital is the Guernsey Structured Products. This specialized product provides investors with customized investment solutions tailored to their specific needs and risk appetite. By utilizing sophisticated financial engineering techniques, Gessler Capital ensures that their structured products are well-suited to the unique goals and preferences of their clients. This flexibility and customization further enhance the expansion of financial networks, allowing investors to access previously untapped opportunities.

How To Create European Medium Term Note (EMTN) Luxembourg

Overall, Gessler Capital’s commitment to expanding financial networks is evident through their comprehensive range of securitization and fund solutions. As a Swiss-based firm with a global reach, they are at the forefront of fostering collaboration and connectivity in the financial industry. Through their innovative offerings and expertise, Gessler Capital is contributing significantly to the unveiling of new horizons for financial network expansion.